Jeff Galzic’s DeFi Protocol Vesper Finance has raised $100 million in six weeks, taking the top spot on TVL.

The DeFi dividend platform Vesper Finance (VF), co-founded by Bitcoin Core developer Jeff Garzik, has secured a $1 billion total deposited asset (TVL) within six weeks of launch.

The recently launched DeFi (decentralized financial service) dividend platform VF has surpassed $1 billion in TVL within six weeks of launching the mainnet.

Galjik, an executive of blockchain technology company Bloq Inc, said on Twitter on the 23rd (local time) that the team has unveiled the smart contract. In addition, the VF CEO uses the protocol’s open source transportable NFT container to *ERC-20 I mentioned that s can be packaged, sent and auctioned.

( ERC: Ethereum Request for Comment Standard protocol for tokens issued on the Ethereum blockchain network. The number ’20’ is attached to the Ethereum community when the proposals uploaded in the order of 20 are selected in the process of discussing the ERC standard by developers.)

The protocol has seen remarkable growth after collecting $25 million in TVL during the beta period from December 22nd to February 17th. By March 9th, the total value of VF has grown to $500 million, and has doubled over the past two weeks.

According to DeFi Lama, a decentralized financial analytics firm, VF currently stands at $1.09 billion TVL, the 15th largest protocol, followed by the Badger DAO (decentralized autonomous organization). , 14th is Autofarm

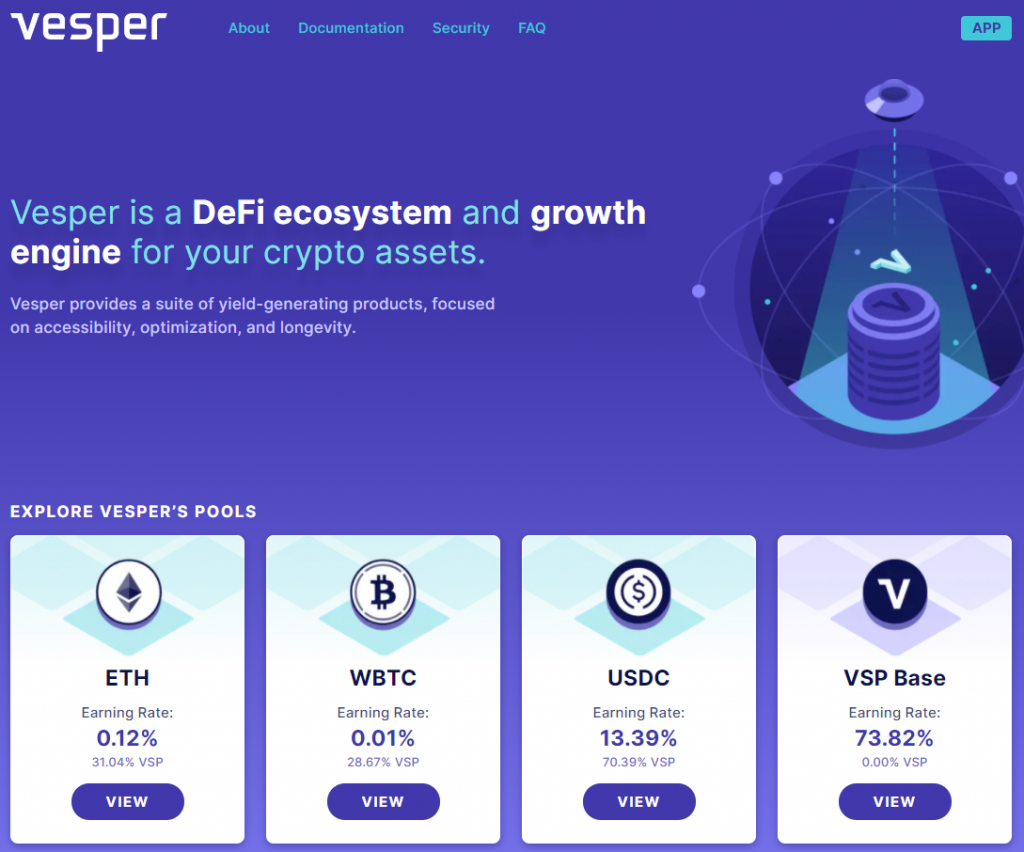

The platform currently offers five single asset pools, with dividends provided to those who deposit DAI, USDC, ETH, WBTC or VF’s own token, VSP. Also, for most assets, rewards are provided in the form of VSP.

The WBTC Vault is currently the most popular pool containing nearly $420 million, followed by an ETH of $382 million, USDC of $222 million, and VSP of $72 million. Only $259,074 was deposited into the DAI pool.

Currently, all VF’s pools are set to a “conservative” risk level, and the team said pools that offer a higher risk profile will be released in the future.

Meanwhile, VF was co-founded by billionaire investor Jeff Galzik, co-founder of Block Inc. Matthew Rozak, and Jordan Kruger, CEO of Defy Inc.